Leon Neal/Getty Images

Whenever it seems like the media marketplace has hit some kind of cosmic limitation on complicated business pertaining to Elon Musk, somehow reality provides. For instance, it turns out Sam Bankman-Fried of the collapsing, possibly felonious FTX cryptocurrency exchange, could have owned a sizable chunk of Musk’s mess had events turned out just a little bit differently.

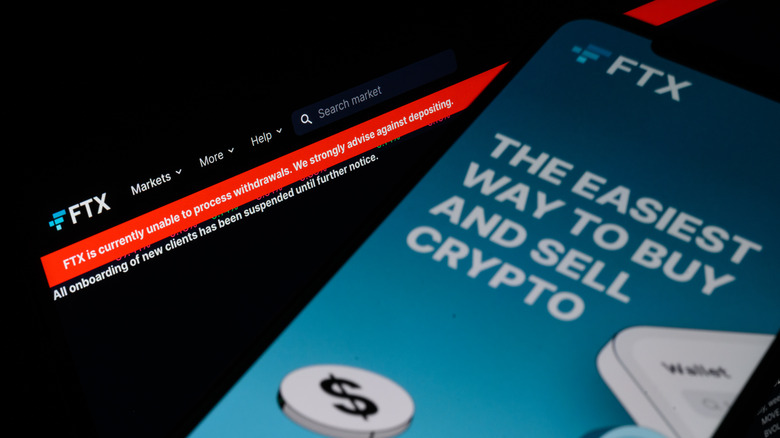

First, a fast recap. Elon Musk bought Twitter. Chaos ensued. Right now, we’re hesitant to say whether Twitter will survive the acquisition, let alone prognosticate a probable outcome. Meanwhile, a massive user exodus from the FTX crypto exchange has left the company scrambling for funds to cash out its customers. Sources indicate something to the effect of a $9 billion shortfall. People involved with FTX, particularly Sam Bankman-Fried, are facing serious legal action (via Reuters) and the exchange’s best chance of rescue, purchase of its outstanding tokens by competing exchange Binance, just pulled out.

In short, it’s been an eventful few weeks for global business, and there’s lots of red meat for us lucky suckers in the media. That said, we can only dream of the newsworthy nonsense that might have ensued had those two catastrophes somehow synergized – and it nearly happened.

Chaos, cryptocurrency, and the future of social media

photo_gonzo/Shutterstock

New information regarding Sam Bankman-Fried and Twitter has come to light following the release of formerly private messages in the course of the now-halted lawsuit between Musk and Twitter regarding the former welching on his original purchase offer (per Fortune). Prior to Musk’s purchase, he had been vocal on his own Twitter account about perceived censorship (not censorship he likes, naturally, but censorship against him) and the frustrating fragmentation of social media across multiple services.

Sam Bankman-Fried did what he does. He got in touch with Musk and proposed blockchain as a solution. According to sources at crypto news platform Forkast, Bankman-Fried contacted Musk at a frustrating point in his talks with Twitter, offering a partnership going forward. His vision seemed to be a blockchain-based approach to Twitter data security, potentially providing a backbone for a whole suite of services to take on Facebook, Instagram, and other major players in the space. The same sources indicate Bankman-Fried was prepared to put serious skin in the game, offering from eight to $15 billion.

Obviously, as Musk elected to proceed with the purchase of Twitter alone, and Bankman-Fried has since developed serious cash flow problems, blockchain on Twitter will likely remain a “what if?” for the foreseeable future. Still, the idea stands, and even if Musk intends to keep Twitter as a private fiefdom, plenty of other social media outlets enjoy money and could use better security. The future of decentralized social media will have to wait, but the possibility remains.