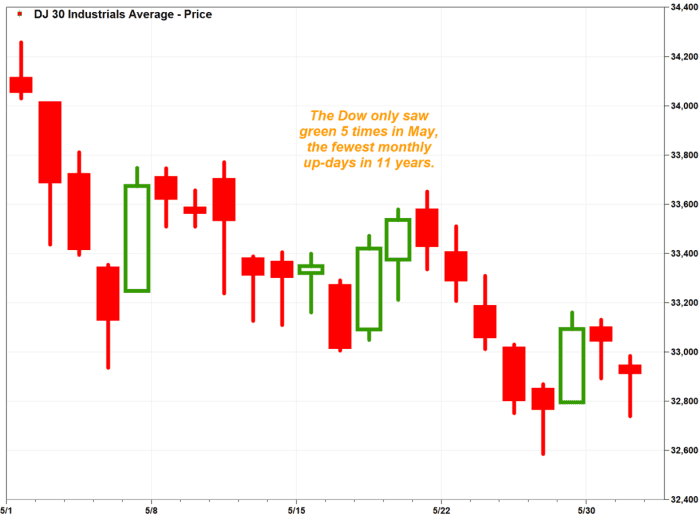

The Dow Jones Industrial Average, which was the only one of the Big 3 stock-market trackers to have a losing May, suffered its worst month in terms of daily gains in 11 years.

The Dow DJIA,

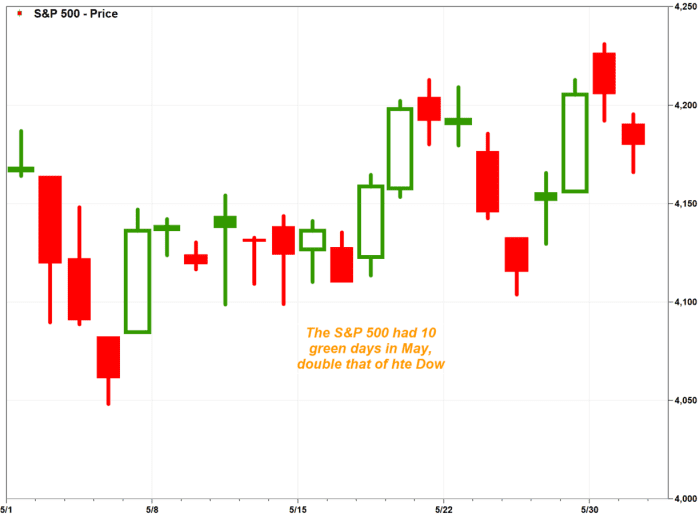

In contrast, the S&P 500 index SPX,

What makes the Dow’s relative weakness stand out is that of May’s 22 trading sessions, the Dow gained ground only five times. That’s the fewest daily gains in any month since it rose in five of 22 sessions during May 2012.

The next fewest monthly up days was six, out of 21 sessions, in August 2015.

During May, the Dow suffered two five-session losing streaks and one four-session losing streak.

Meanwhile, the S&P 500 gained 10 times in May and the Nasdaq Composite advanced 11 times.

Within the Dow, only six of 30 components, or 20%, gained ground during May, led by Salesforce Inc.’s stock CRM,

The biggest percentage decliner was Nike Inc.’s stock OF,

For the S&P 500, 124 components, or about one-quarter of the index, rose in May. The biggest gainer was Nvidia Corp.’s stock NVDA,