After cutting memory chip prices, Samsung announced a drastic 95% drop in year-on-year profits for the quarter, forcing it to join the list of chip makers which will be cutting production production as well, on account of the recessionary slump in sales. The long-term goal to invest in new manufacturing capacity still stays, though.

Instead of announcing deep production cuts after the memory chip demand slump in Q4, like its competitors from Micron and SK Hynix, Samsung actually said that it will increase its capital expenditures. That is its usual modus operandi when a recession hits the electronics market, as it sacrifices operational margin in order to gain market share while the others are down.

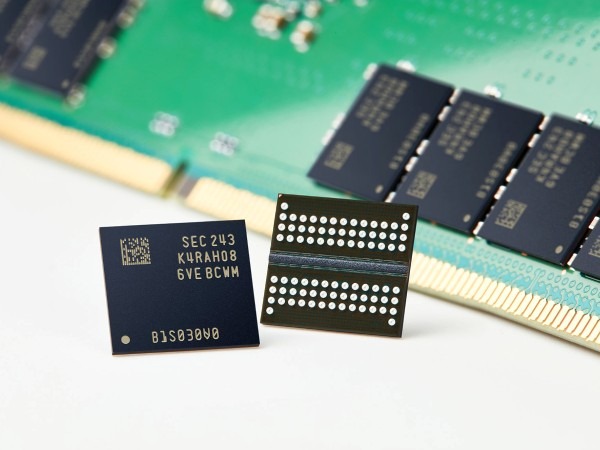

Such was the continued slump in the January-March period, however, that Samsung announced its first memory chip production cuts just now, waving the manufacturing white flag just as its main competitors did. It briefly reported preliminary Q1 operating profit of just about US$455.5 million, giving a hint what might have been the reasoning behind its unprecedented decision to decrease production, at least in the short run.

These profit numbers are a giant 96% drop compared to the US$10.7 billion or so it reported just a year ago in the same period. It is also the first quarter in 14 years when Samsung Electronics’ operating profit has fallen below 1 trillion won. The semiconductor division alone likely lost the record US$1.6 billion this past quarter, and is expected to repeat that negative achievement in the current one.

The market interpreted Samsung’s announcement of a “meaningful” decrease in chip production as positive news and sent all chip shares higher. The logic is similar to what happens after an OPEC production cut announcement which reduces supply and keeps oil prices steady or climbing.

Coupled with the previous SK Hynix and Micron cuts, analysts argue, Samsung’s decision would mean a market rebound in the second half of the year. Major customers should have drawn down on inventory levels they amassed during the pandemic-induced supply chain crisis by then, and start ordering again.

Moreover, Samsung didn’t announce any changes in its capital expenditure plans for the year, so it might be banking on the same outcome. While it cuts production in the short run, it would apparently keep investing in capacity expansion and research as planned, in order to have expanded its market share when the demand situation improves:

In addition to optimizing line operations for the future and increasing the proportion of engineering runs, which are already in progress, we are lowering memory production to a meaningful level, focusing on products with additional supply secured. The short-term production plan has been lowered, but solid demand is expected in the mid- to long-term.

Related Articles

Daniel Zlatev – Tech Writer – 663 articles published on Notebookcheck since 2021

Wooed by tech since the industrial espionage of Apple computers and the times of pixelized Nintendos, Daniel went and opened a gaming club when personal computers and consoles were still an expensive rarity. Nowadays, fascination is not with specs and speed but rather the lifestyle that computers in our pocket, house, and car have shoehorned us in, from the infinite scroll and the privacy hazards to authenticating every bit and move of our existence.

Daniel Zlatev, 2023-04- 7 (Update: 2023-04- 7)