© Reuters. FILE PHOTO: Japanese Yen and U.S. dollar banknotes are seen in this illustration taken March 10, 2023. REUTERS/Dado Ruvic/Illustration

© Reuters. FILE PHOTO: Japanese Yen and U.S. dollar banknotes are seen in this illustration taken March 10, 2023. REUTERS/Dado Ruvic/Illustration

By Hannah Lang

WASHINGTON (Reuters) – The dollar slid on Monday as investors reacted to UBS’ cut-price takeover of its beleaguered rival Credit Suisse CSGN.S.

UBS UBSG.S agreed to buy Credit Suisse on Sunday for 3 billion Swiss francs ($3.23 billion) and assume up to $5.4 billion in losses, in a shotgun merger engineered by Swiss authorities. The=USD – which measures the currency against six major peers – was last down 0.501% at 103.270 the day after the merger was announced, touching its lowest level since Feb. 15.

Meanwhile, growth assets such as bitcoin BTC=enjoyed a bounce. The world’s largest cryptocurrency hit a nine-month high on Monday and last rose 4.62% to $28,065.00.

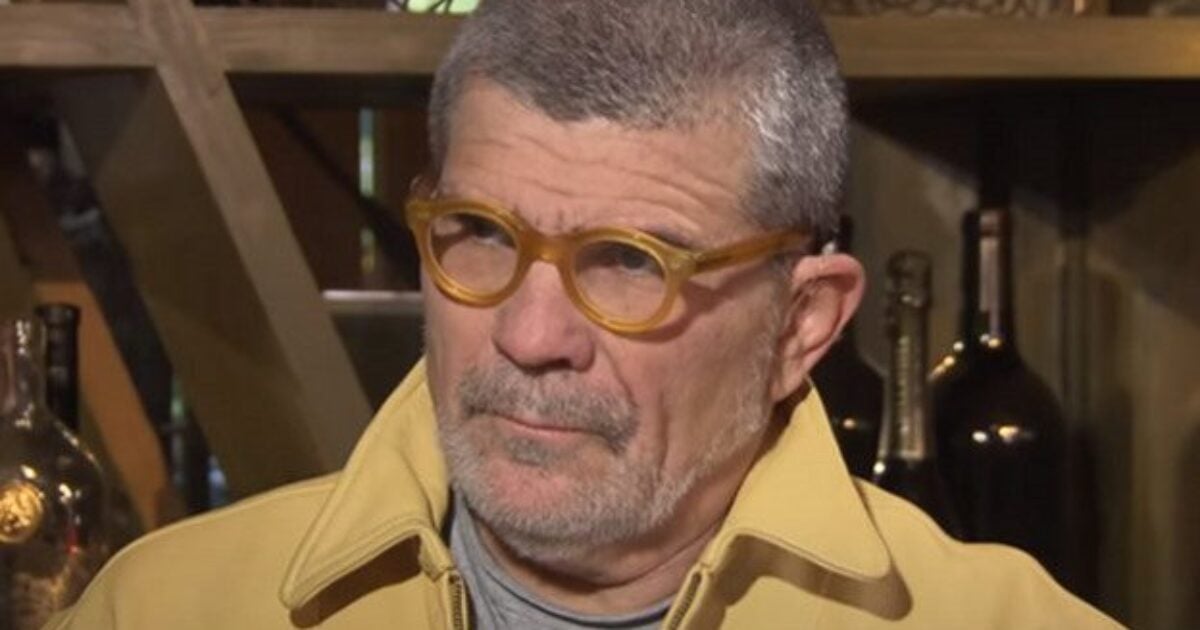

“I think whenever people feel like you don’t have to do a flight to quality, the dollar is going to take a hit,” said Thomas Anderson, managing director at moneycorp North America.

Also weighing on the dollar are concerns about regional U.S. banks, despite several large banks depositing $30 billion last week into First Republic Bank (NYSE:) FRC.N, the U.S. lender drawing the most unease from investors. First Republic shares tumbled as much as 50% on Monday and were last down about 39%.

“In particular, there are risks developing, or at least some degree of uncertainty, with the regional U.S. banks that I think are weighing on U.S. assets at this point as well,” said Bipan Rai, North America head of FX strategy at CIBC Capital Markets in Toronto.

Under the UBS-Credit Suisse deal, holders of $17 billion of Credit Suisse Additional Tier-1 (AT1) bonds will be wiped out. That angered some of the holders of the debt, who thought they would be better protected than shareholders, and unnerved investors in other banks’ AT1 bonds.

The euro was last up 0.54% against the dollar at $1.0724, while the British pound GBP=was last trading at $1.2281, up 0.87% on the day.

The dollar CHF=rose 0.24% against the Swiss franc at 0.928.

Graphic: Fed currency swaps have seen little recent use https://www.reuters.com/graphics/USA-FED/SWAPS/jnpwyjwonpw/chart_eikon.jpg

ALL EYES ON THE FED

The Federal Reserve’s latest decision on interest rate hikes is due on Wednesday and adds an additional layer of uncertainty for investors.

Rates currently stand at 4.5% to 4.75%. Traders now expect a peak in rates in May at around 4.8%, followed by a steady series of cuts into the end of the year, but will be closely watching the forecast for future rate moves that the Fed is expected to unveil on Wednesday.

“The path of least regret, at least from our view, is to keep (forecasts) consistent with where they were in December. Given that the risks have now risen to the domestic financial sector, I think that’s probably the prudent course of action for them,” Rai said.

The Japanese yen – long seen as a safe haven at times of stress – strengthened 0.28% versus the greenback at 131.47 per dollar.

Australia’s dollar AUD=rose 0.33% versus the greenback at $0.672, while the Canadian dollar rose 0.52% versus the greenback at 1.37 per dollar.