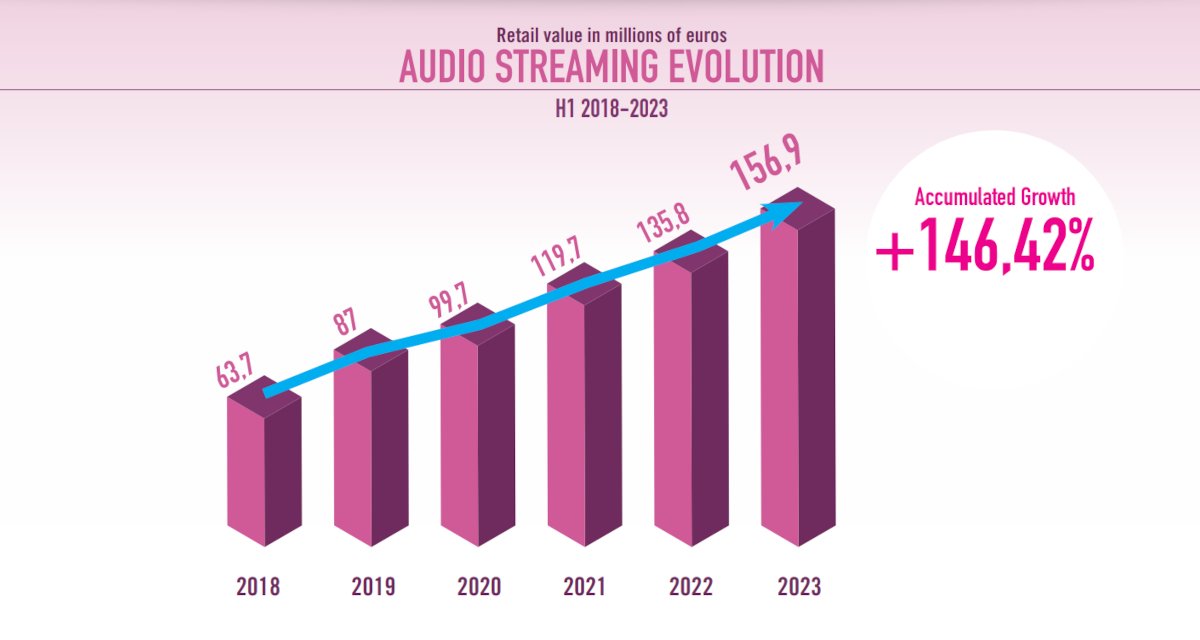

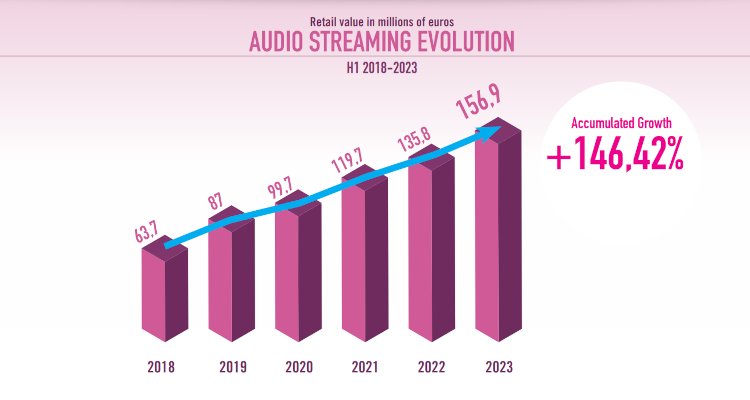

A visual resource showing the triple-digit streaming revenue growth within the Spanish music industry between H1 2018 and H1 2023. Photo Credit: Promusicae

The Spanish music industry grew almost 12% during 2023’s opening half, when streaming accounted for nearly 87% of revenue, according to newly released data.

Productores de Música de España (Promusicae) reached out to DMN this morning with Spain’s H1 2023 recorded music industry stats. According to the appropriate resource, the European nation of about 48 million generated €214.3 million (currently $229.46 million) in recorded revenue during Q1 and Q2, up about 11.53% from H1 2022.

Behind the H1 2023 sum, Promusicae pointed to €186.17 million/$199.34 million in streaming revenue (up 13.26% YoY), including €156.97 million/$168.07 million from audio streams (up 15.54% YoY) and the remaining €29.20 million/$31.27 million or so from video streaming (up 2.4% YoY).

Predictably, given these figures and longstanding trends, downloads (€1.52 million/$1.63 million, down 8.05% YoY) and mobile offerings including ringtones (€899,000/$962,716, down 20.88% YoY) slipped during the six-month period, per the Madrid-based organization.

Shifting to the physical side, Promusicae identified revenue of €25.73 million/$27.55 million (reflecting 2.4% YoY growth), which resulted largely from a 6.32% YoY sales spike for vinyl and its €14.46 million/$15.48 million H1 2023 contribution to the Spanish music industry. CD sales came out to €11.04 million/$11.82 million (down 1.32% YoY), the breakdown shows.

Rounding out the physical category, the entity acknowledged €96,000 ($102,804) in music-video sales, besides €145,000 ($155,270) in revenue from other sources. In a statement, Promusicae president Antonio Guisasola touted the showing and took the opportunity to call for authorities “to decide once and for all to support the Spanish recording industry.”

Doing so, the nearly 22-year Promusicae head indicated, will help the Spanish music industry to “seize the great momentum experienced by Latin music to consolidate its growth in our country and abroad.”

Elsewhere in Europe, Bundesverband Musikindustrie (BVMI) in late July revealed that Germany’s own recorded music space had generated €1.06 billion ($1.14 billion) during 2023’s first half, for a YoY improvement of 6.6%. Streaming made up 75.7% of the total, though vinyl still managed to command an even 6% of the overall market, per BVMI.

Italy’s industry representative, for its part, disclosed late last month that the nation’s recorded music market had grown 14.2% YoY, for €176.09 million ($188.56 million) in revenue, during H1 2023. Digital contributed 84% of the figure, and vinyl nevertheless achieved a double-digit boost, the Federazione Industria Musicale Italiana also relayed.

Most recently, the French music industry was said to have pulled in €397 million ($425.11 million) during H1 2023 – up 9.4% YoY – with streaming representing 77% of the sum. Miley Cyrus’ “Flowers” racked up the most streams of any song in France during the six-month stretch, SNEP specified.